Illustration by Peter and Maria Hoey | Design and development by Elizabeth Davis and Patrick Roth

Top Defined Contribution

(Assets in billions)

| # | Name | 2021 | 2020 | 2019 |

|---|---|---|---|---|

| 1 | Federal Retirement Thrift Investment Board | $774.2 | $651.1 | $601 |

| 2 | Boeing | $74.7 | $69.5 | $66.3 |

| 3 | IBM | $63.5 | $55.6 | $53.6 |

| 4 | AT&T | $61.4 | $68.5 | $68.1 |

| 5 | Bank of America | $54.6 | $42.6 | $41.9 |

| 6 | Raytheon Technologies | $53.8 | $48.3 | $47.8 |

| 7 | Wells Fargo | $53 | $47.4 | $43.2 |

| 8 | Lockheed Martin | $49.6 | $47 | $42.8 |

| 9 | Verizon | $42.8 | $35.6 | $34 |

| 10 | Microsoft | $41.7 | $27.7 | $24.9 |

Top Defined Benefit

(Assets in billions)

| # | Name | 2021 | 2020 | 2019 |

|---|---|---|---|---|

| 1 | California Public Employees' Retirement System | $494.5 | $424.3 | $382.7 |

| 2 | California State Teachers' Retirement System | $312.2 | $257.9 | $242.1 |

| 3 | New York State Common Retirement Fund | $267.8 | $226.4 | $215.4 |

| 4 | New York City Retirement Systems | $266.7 | $225.5 | $208.5 |

| 5 | Florida State Board of Administration | $199 | $168 | $162.5 |

| 6 | Teacher Retirement System of Texas | $196.7 | $162.7 | $157.6 |

| 7 | New York State Teachers' Retirement System | $144.4 | $122.8 | $119.7 |

| 8 | State of Wisconsin Investment Board | $140.9 | $118 | $111.5 |

| 9 | Washington State Investment Board | $135 | $107.3 | $99.9 |

| 10 | North Carolina Retirement System | $121.3 | $107.5 | $102.4 |

Get the Data Powering the P&I 1,000

Need a deeper dive? Explore your options below:

Summary Report

Get topline benchmarking and asset allocation trends based on key findings from the P&I 1,000 annual survey of U.S. Pension Funds. Make sure you’re prepared for the tough road ahead in 2022.

Data APIs

Need historical trends, detailed data points or current contact information? Put the full power of P&I's data to work for you and your team with an API integration directly into your CRM and analytical systems.

Research Center

This customizable, easy-to-use analytical tool provides detailed profiles and data on pension funds, money managers, investment consultants and defined contribution record keepers.

Private credit soars 77% as asset class continues to heat up

Private credit has been on a tear with the largest U.S. pension plans, and that's showing little signs of stopping anytime soon.

Video: P&I 1,000 by the numbers

Each year P&I collects data on the largest 1,000 U.S. retirement plans. With data animation, viewers can easily compare size, scope and changes in allocations.

Institutional investors seek returns in high yield, inflation protection

Inflation hammered fixed income in 2021, with looming future interest rates creating yet another headwind for asset owners.

Record year for deal value vaults venture capital, private equity

Private equity and venture capital assets among the top 200 funds were supersized by returns and deal pace.

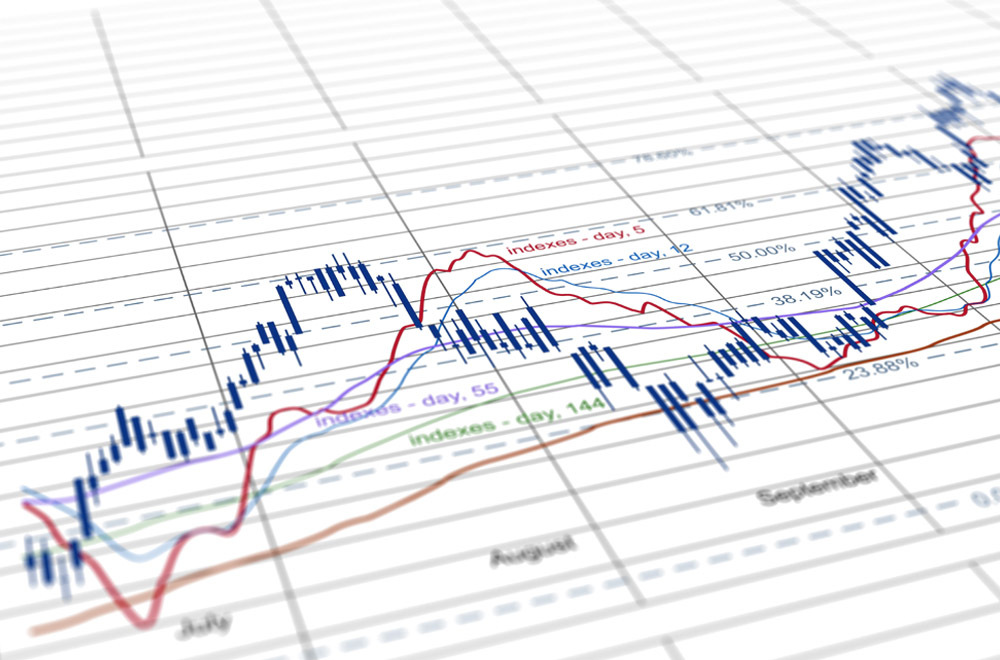

Change in assets by category

Assets in billions for years ended Sept. 30.

Participants shake off challening year

Among the 200 largest retirement plans, DC assets rose 17.6% to $3.31 trillion on the backs of roaring markets and participant inertia.

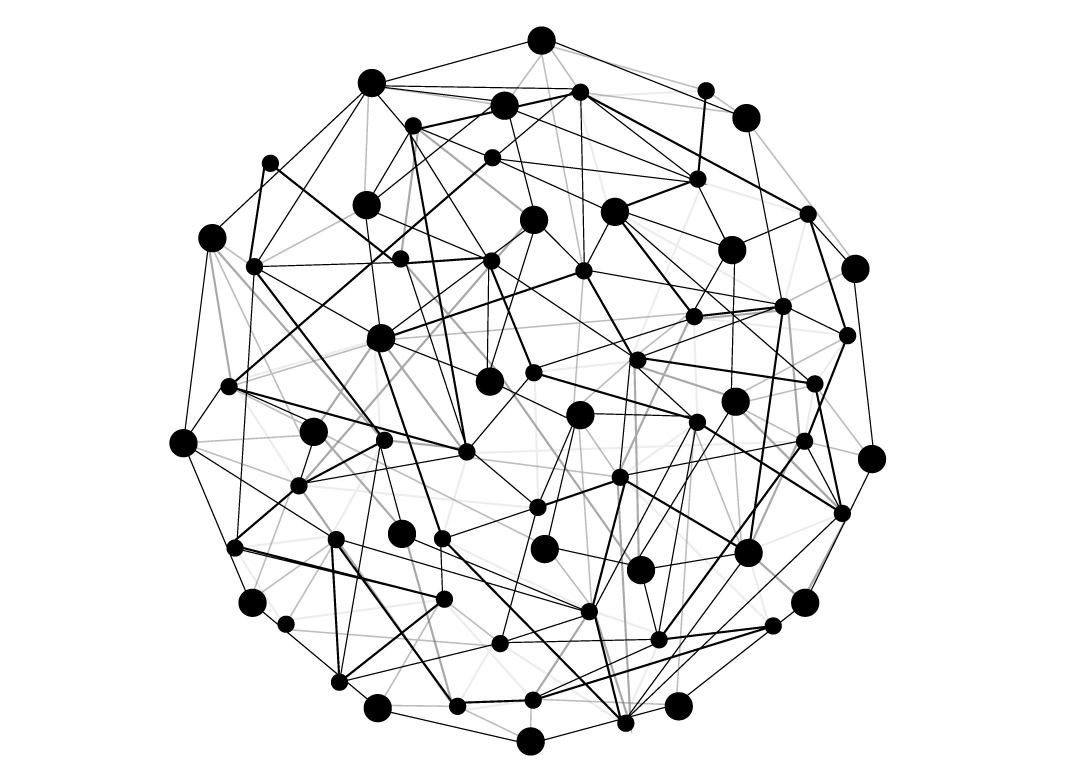

Managers most used by the top 200 funds

Total mentions across all asset classes

Pension plans increasingly see benefit in allocating to diverse managers

More U.S. pension funds are creating programs and initiatives to increase their exposure to diverse money managers.

Biggest Gainers

Highest total asset growth among top 200 funds

A heady year, but will it last?

Despite the pandemic, retirement plan sponsors arguably find themselves in the best financial positions since before the global financial crisis.

Consultants most used by the top 200 funds

Total mentions across all asset classes

How this year's survey was conducted

Pensions & Investments gathered information for its report of the largest retirement funds, published annually since 1974, in three steps.