FOCUS ON INDIVIDUAL OUTCOMES

The past year was historic for investors, with the 60/40 portfolio suffering one of its worst slumps due to poor performance from equities and bonds, along with the sharp rise in interest rates by the Federal Reserve to curtail inflation. In response, defined contribution plan sponsors have been reassessing their investment menus to ensure suitability for participants. They are introducing enhancements to the default option, typically target-date funds, and the core menu. And they are moving forward on providing greater customization and personalization of products and advice that can help individual participants meet their retirement needs.

The year was also notable for the passage of SECURE 2.0 legislation in December and the Department of Labor’s November ruling that clarified how defined contribution plan sponsors may consider environmental, social and governance factors. These regulatory changes have led more DC plans to evaluate and consider ESG offerings.

Innovations in DC Webinar

Diversifying fixed income

“Many DC plan sponsors were disappointed in 2022 to see both equity and fixed-income strategies struggling simultaneously. Looking to 2023, we anticipate more plan sponsors will be revisiting how their plans offer participants access to fixed-income markets, either in a target-date solution or the core menu,” said Jessica Sclafani, senior defined contribution strategist for the Americas division at T. Rowe Price. She added, “A well-diversified portfolio can help navigate market volatility and smooth out performance.”

T. Rowe Price has strengthened its target-date strategies to combat a more recent concern: inflation. “In 2017 we added inflation-hedging assets to our target-date glidepaths by implementing real assets within the equity allocation and shifting short-term bond exposure to a TIPS exposure. These decisions proved beneficial to participants in 2022, as we experienced inflation for the first time in many years,” Sclafani said, with reference to Treasury Inflation-Protected Securities.

“We’ve made fixed-income enhancements to target-date portfolios to include a more diversified suite of fixed-income exposures along the glidepath,” Sclafani said. “These updates create a bond allocation that [can] perform under a variety of market conditions.”

She said she also sees further opportunities for diversification in fixed income in the year ahead. A recent T. Rowe Price survey of plan sponsors found that 79% believe that it’s important to offer participants a range of fixed-income options. The survey also showed that more than half of respondents believe stable value will become even more attractive.

A role for annuities

“The macro environment, with double-digit market drops in both equities and fixed income in 2022, is driving a lot of plan sponsors to look at fixed-income annuities. We are seeing a lot of growth in this category,” said Brendan McCarthy, head of retirement investing at Nuveen, the $1.1 trillion global asset manager of TIAA. McCarthy pointed out that annuities provide positive yield regardless of market conditions.

Since annuity products are restricted from being included in the traditional funds of the Investment Company Act of 1940, such as mutual funds, McCarthy said plans are turning to other investment vehicles, mainly collective investment trusts, to house them. “We expect to see innovation in investment vehicles within the CIT world to incorporate guaranteed income,” he said.

When it comes to investment solutions for the accumulation phase, McCarthy said plans are reviewing their target-date funds. “Upwards of 80% of investment flows go into target-date funds. Is the fund still meeting the needs of the plan participants? Have those needs changed? Has the product done what it was supposed to do? We expect a review of target-date funds and the QDIA to be top of mind for plan sponsors in 2023,” he said, with reference to the qualified default investment alternative.

Back to basics

“Two areas of the macro environment are impacting DC plan design: the market and the regulatory evolution, with the passage of SECURE 2.0 and the [DOL final] guidance around ESG and proxy voting,” said Brian Abshire, partner and head of DC multi-asset solutions at Aon.

Market volatility combined with inflation and rising interest rates has caused plans to reassess investment basics, he said. “This is a pause-and-assess moment for plan sponsors.” Last year put a lot of pressure on stable value, creating the opportunity to reeducate plan sponsors around the benefits of stable value,” he said.

In the year ahead, Abshire said he sees investment opportunities to further diversify in fixed income, particularly high-yield and emerging markets, as well as a shift toward additional types of investment vehicles. “We are introducing more CITs and separate accounts with attractive fee schedules. We continue to see more utilization of these,” he said.

Abshire’s investment message to plans for the year ahead: “Focus on the basics. Do you have the right types and number of funds? Make sure you are comfortable with participants’ plan experience from an investment perspective.”

Data and technology

Customization in DC is a big innovation theme for the year. This precision approach to plan design is driven by new data approaches and technology, offering personalized solutions for participants that were unthinkable until recently.

“In the past, for personalization you would need to call in and talk to an advisor. Now [using] data aggregation, automation and intelligent modeling, it’s possible to create a customized solution for an individual based on specific circumstances and needs,” said Abshire. Advances in technology are also reducing the costs for plan sponsors, he noted.

This dual trend — increased personalization and reduced costs — is at the heart of DC innovation going forward: “Personalized target-date funds and personalized asset allocation strategies are areas where the provider space has developed solutions that can be implemented in an efficient and low-cost way,” he said. The use of nontraditional asset classes, like alternatives, also fits into this framework. “Custom asset-allocation solutions may take into account diversification beyond traditional equities and fixed income,” Abshire said.

The custom route

Customized target-date fund construction is another area of rapid DC innovation. “You can include different instruments, sometimes referred to as ‘noncore options’ within this portfolio, such as embedded annuities or alternatives. The ability to create custom portfolios can better meet participants’ needs or [be used to create] a specific risk-return profile for a plan,” said Nuveen’s McCarthy.

Head of Retirement Investing

“Technological advancements are [enabling plans] to offer more personalized services — such as managed accounts that customize the retirement-investment offering,” he added. “And technology should provide participants a more enjoyable experience through both the accumulation and decumulation phases of their retirement plan.”

Dual QDIAs

The retirement industry’s focus on personalization will continue to be driven by advances in technology which support scale and reasonable costs, said Sclafani at T. Rowe Price. “Our multi-asset team has researched how to best deliver a personalized-investment solution building off of our glidepath methodology. We are also exploring how we can complement a target-date solution with a more personalized approach for participants nearing retirement using a dynamic, or dual, QDIA structure.” A relatively new concept, the dual QDIA involves a target-date fund for the saving phase that transitions into a managed account, based on specific criteria, as the participant approaches retirement. “Once participants reach a certain age or amount of retirement savings, they may benefit from the more personalized experience of a managed account,”

Sclafani said.

Read: Secure 2.0 Passed—What Plan Sponsors Need to Know

The dual-QDIA solution utilizes technology and data now available from record keepers. T. Rowe Price’s research showed 92% of sponsors find the dynamic solution “interesting,” with higher engagement among older participants expected. “This is a development we are excited about. We’re exploring multiple levers to create value for clients [based on] personalization. It’s a continuation of our philosophy [around] target-date funds,”

she said.

FINANCIAL WELLNESS EVOLVES

holistic participant experience

The meaning of financial wellness varies by organization, said Abshire at Aon. “Some want a 360-degree high-touch approach, helping their plan participants manage within all ranges of their financial life, not only professionally but personally outside of work. And for others, it’s making sure that participants have the tools when they may need them.” Some employers have moved to provide more comprehensive financial benefits, including student loan payments, emergency savings accounts and health-care related tools, alongside the DC plan. (See graph on employees’ preferences on financial wellness.)

Whatever the approach, the passage of SECURE 2.0 has provided additional clarity and guidance around several financial wellness plan offerings, said Abshire, including employer matching contributions for qualified student loan repayments and the ability of employers to offer emergency savings withdrawals by participants. “These components will get more focus from sponsors because of the new regulatory guidance in SECURE 2.0,” he said.

Talent retention

Many plan sponsors understand that thoughtful financial wellness solutions can support retirement readiness, and these benefits can function as a key tool to attract and retain talent. “They serve as a key differentiator in a competitive labor market,” said Sclafani at T. Rowe Price.

Employers are increasingly aware that various employee segments can have different savings priorities, Sclafani said. “As an example, student loan debt can be an important topic for plan sponsors [that may have a younger] participant demographic.”

She added: “Thoughtful implementation of financial wellness initiatives that align with employee demographics can further support an employer’s [diversity, equity and inclusion] efforts related to saving for retirement. For example, education on paying down debt can be powerful, particularly if it’s delivered using an employee-resource group, which can be a safe place for many employees.”

Sclafani pointed to the power of personalized tools for effective wellness solutions: “Data from the T. Rowe Price record-keeping platform shows that when we were able to personalize participants’ experiences, they were twice [as] likely to increase their deferral rate and to designate a beneficiary, and they were four times more likely to visit educational resources on our planning page.”

THE ESG JOURNEY CONTINUES

plan sponsors

In November 2022, the Department of Labor issued a final rule clarification that would allow plan fiduciaries to consider environmental, social and governance factors when they select retirement investments. Formally known as the rule on Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights, it marked a reversal from the previous administration, when plan fiduciaries were prompted to focus on financial factors rather than “nonpecuniary” factors.

The November DOL rule clarification adds support to ESG investing, but demand had already been strong before it was finalized, said McCarthy at Nuveen. “We have seen consistent uptake of ESG investments in DC plans, regardless of the back and forth that occurred with the rule.”

McCarthy pointed out that in Nuveen’s 2022 Responsible Investing Survey, four of five (80%) respondents agreed that investors should view responsible-investing as a long-term strategy — and 76% said that factoring in responsible-investing risks and opportunities should always be part of the investment process.

The demand is two pronged: “Participants are asking for ESG funds, because they want to invest their retirement money in a way that aligns with their personal values. In addition, these funds are viewed as helpful to investment performance, like mitigating market risk,” McCarthy said. ESG has long been positioned as a way to reduce material risks, including climate risks, to a portfolio, he added. The demand for ESG-embedded investments is making its presence felt both on the DC fund lineup and in ESG integration into the investment process by asset managers. “We are seeing the addition of an ‘ESG tier’ to the plan investment menu so that participants can invest in various ESG strategies,” he said.

Pending implications

While the DOL’s recent ruling provided some clarification, it is likely that DC plan sponsors will want to engage in further dialogue with the agency before there are any dramatic changes to investment lineups. “We want to make sure, as a community, that we fully understand the implications and impact of the rule. The dialogue continues to evolve about what can and can’t be done under the new rule,” noted Abshire at Aon.

Open questions around the rule include adding passive or explicit ESG investments to a plan’s lineup, he said. “What could the rule mean with regards to an ESG-tilted or -themed index strategy? How do they operate from a proxy voting standpoint?”

Whatever the ultimate outcome in terms of implementation, “plans want to talk about the rule and have a dialogue around where they want to go with it,” he said.

DEI takes root

As DC plan sponsors confront a tighter labor market and more diverse labor force, many are moving to incorporate diversity, equity and inclusion principles into the retirement plan.

“DEI is already an important theme at the enterprise level for many clients, and we are seeing that filter through to the retirement plan,” said Sclafani at T. Rowe Price. There’s a growing recognition by employers that financial differences exist among minority cohorts, and they are exploring the intersection of retirement and their broader strategy for DEI. “The organization’s benefits program may be a way to address some of these differences,” she said.

DC plans had traditionally assessed participant savings and investing behavior by age or gender, Sclafani said, “but today some sponsors are also including racial cohorts in their analysis.” She added, “The workplace remains the most important source of advice and support for all retirement savers, and even more so for minority savers.” (See graph.)

Recent T. Rowe Price research found that while 38% of white participants started saving for retirement before age 30, only 18% of black workers reported doing so. In addition, minority savers, particularly black workers, expected to retire earlier than white workers. “This suggests that minorities have a shorter window to grow their assets,” Sclafani said, adding that plan design features, such as the use of automatic features, can help address this challenge.

Using the DEI lens and data in DC plans can transform outcomes for the better, she added. “We’re encouraging plan sponsors to understand the needs and opportunities of different populations of employees that [the current] retirement [plan] may unintentionally be leaving behind. We can then look to plan design to remove these behavioral barriers to saving.”

Manager diversity

Aon’s Abshire sees DEI considerations entering discussions around manager selection: “Plan sponsors are asking questions about how many of their investment managers could be considered diverse or minority owned.” Using DEI criteria to help choose managers varies by type of plan and sponsor, he said. Many corporate plan sponsors are engaged in initial dialogue on this aspect, but several nonprofit and public plans have already moved past this stage and have formulated a strategic plan with DEI-manager targets, he said.

For plan sponsors earlier on in the evaluation stage, their focus is on accessing high-quality managers who may also fit within the scope of the DEI framework, Abshire said. “It’s a reasonable goal while keeping the focus on delivering the best return and participant experience.”

The gender gap

Among the issues emerging as corporations strengthen DEI is gender inequality in retirement. “One particular area of focus is the gender gap in retirement — the fact that women, on average, retire with 30% less income in retirement than men,” said McCarthy at Nuveen.

The reasons for this gap are many. “There is gender pay inequality in corporations, with U.S. women on average earning only 82 cents on the dollar of men,” McCarthy said. Women also leave the workforce and retire earlier than men, yet they live longer.

“In order to fix this issue, we first need to make everyone know that it exists,” he said. TIAA is addressing that through its “retire inequality” campaign, which draws awareness and helps the retirement industry close the retirement gap for women and other affected demographic groups, McCarthy added.

DC plan sponsors, in their quest to better help participants achieve their retirement objectives, continue to evaluate and refine their approach to retirement income solutions. They face a wealth of choices: Is there a role for guaranteed income? Do plans need to be redesigned from the bottom up to accommodate it? Should it be in-plan or out of plan? Given the topic’s complexity, many plans are still in the education phase, while others have embraced in-plan solutions.

“There is no silver bullet, and there is no one type of solution that may be best for every plan sponsor or participant,” said Aon’s Abshire. A majority of plan sponsors are in the education and learning phase on retirement income, with implementation to follow. “As a community of plan sponsors, consultants and providers, retirement income is an area we all continue to focus on,” he said.

Guaranteed solutions

While retirement income is a broad category, Nuveen is seeing one solution attract the most attention — guaranteed lifetime-income products, said McCarthy at Nuveen. “Participants are concerned about outliving their retirement income, and plan sponsors are looking for retirement income solutions that offer some form of guaranteed income — similar to a corporate defined benefit plan,” he explained. (See visual below.)

McCarthy also pointed out that many participants mistakenly believe their target-date funds already provide guaranteed income. In addition, sponsors face the issue of reluctant retirees, who work beyond their expected retirement age because of worries about retirement income. “Guaranteed lifetime-income solutions are a way for companies to enable their employees to retire on time or early,” he said.

Simplicity, ease of adoption and low cost are key considerations, said McCarthy. “Annuities can be complex instruments. Plan sponsors are looking for income solutions that are simple for them to explain and easy for their participants to understand,” he said, adding that they also want them to be low cost.

“Plan sponsors are not typically asking participants to directly buy annuities from the investment menu,” he said. Instead, they embed the annuity inside a structure that the participant is already familiar with, such as a target-date fund or a managed account, which offers a portion of return in the form of guaranteed income, McCarthy explained.

Ultimately, plans face the choice of whether their purpose is just to serve as a tax-preferential savings vehicle or as a true retirement plan that offers guaranteed lifetime income, McCarthy said. The most comprehensive approach, he noted, is one that integrates lifetime income through plan design, rather than simply offering an annuity for purchase at retirement. Here “you are looking at the overall plan design from accumulation through decumulation, and you’re factoring in guaranteed income throughout the retirement journey,” he said.

Regulatory support continues to encourage the uptake in annuities by plans, noted McCarthy, citing safe harbor provisions in the first SECURE Act and provisions to make plans more accessible in SECURE 2.0. However, as most record keepers do not currently have the technology to offer third-party annuity solutions, there is a short-term delay to wider adoption. “As access to solutions on record-keeping platforms grow, we expect adoption of lifetime income solutions to grow exponentially,” McCarthy said.

Looking ahead, he noted that “plan sponsors are looking to review the lifetime income solutions that are coming to market to see how incorporating such a solution could help their retirement plan.”

Managed payouts

“Retirement income can’t be solved by a single product or investment solution,” said Sclafani at T. Rowe Price. Instead, she said, “retirement income will be a multiyear, iterative process for plan sponsors that includes an array of investment and insured solutions, all of which need to be buttressed by thoughtful plan design, education and participant communication.”

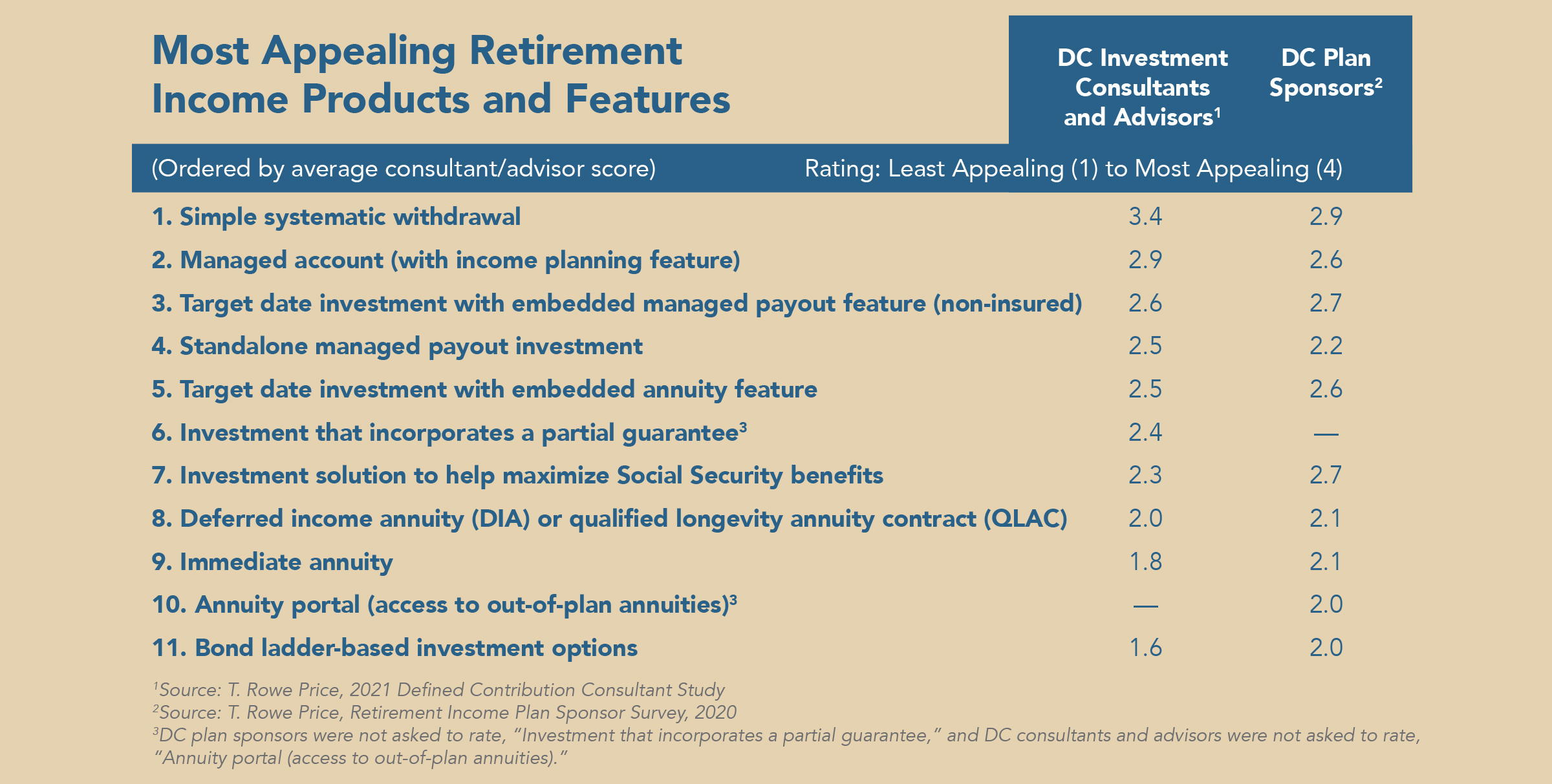

T. Rowe Price recently undertook surveys of plan sponsors and consultants around retirement income, asking them to rank various retirement income products: “The immediate takeaway from the results is there is little differentiation from one product to the next. The marketplace lacks conviction around any single retirement income product or feature,” Sclafani said. In general, though, she said she has observed less market interest in annuities. “We observe greater interest in liquid and portable retirement income solutions rather than guaranteed solutions.” (See table below.)

In 2019, T. Rowe Price launched an in-plan managed payout solution that is offered through the retirement income vintage of the target-date series. “The managed payout solution is generally seen as a feature of the target-date solution that plan sponsors can ‘turn on,’ as opposed to an additional investment that would require its own monitoring,” Sclafani said.

As more plan sponsors become comfortable with this retirement income approach, she anticipates further innovations. “We’re encouraging sponsors to consider building a retirement income ecosystem that includes a plan design that’s able to facilitate retirement income paychecks and a broad array of investments, which may include personalized solutions as well as access to advice,” Sclafani said.