AT AN INFLECTION POINT

Sustainable investing is at a moment of transformation, rapidly moving past a niche or specialist status to a mainstream approach across the asset classes. The acceleration of sustainable investing — the consideration of environmental, social and governance factors, or ESG, along with financial outcomes when investing — has many drivers: More asset owners are recognizing and addressing the threat posed by climate change in their portfolios; improved ESG data availability is making implementation of sustainable-asset portfolios more feasible; and most recently, the Russian war against Ukraine and rising oil prices have highlighted fossil fuel risks and the need for alternative energy. In addition, sustainable investing is deepening coverage to offer new investible themes, such as biodiversity and social impact.

ESG: Sustainability Webinar

“The definition and practice of sustainable investing have evolved over the years,” said Stephanie Rowton, director of ESG Indices at S&P Dow Jones Indices. “It was originally utilized as a method for screening out certain business activities. After the Great Financial Crisis, there was a shift in mindset, and investors started using sustainable investing as a form of risk mitigation and to ensure they were investing in well-managed companies.”

Sustainable investing evolved again, following the Paris Agreement that was implemented in 2016, with a shift in focus toward climate change, Rowton said. That led S&P Dow Jones Indices to offer, and continue to develop, an array of climate-oriented indexes in alignment with the move to a net-zero economy — the United Nations’ led goal to reach net-zero greenhouse gas emissions by 2050. “We’re now starting to see the rationale for sustainable investing evolve further to embrace social change and impact,” Rowton said.

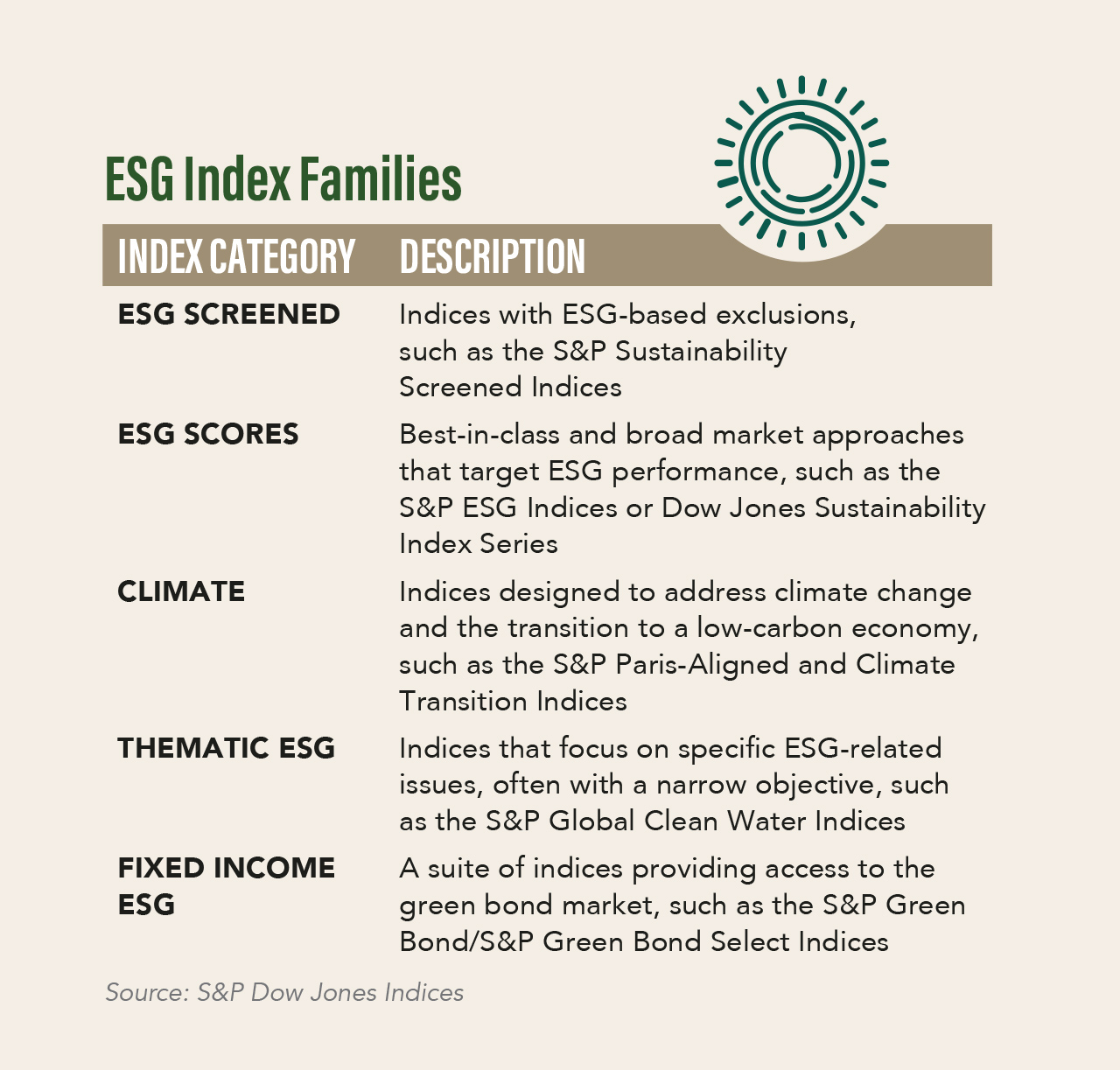

Sustainable investing plays a number of roles in many institutional investors’ portfolios today. “We are seeing it increasingly used as a core allocation within the portfolio rather than just being used as a satellite approach. It is also being used as more than just a benchmark, but also for strategy replication and everything in between,” Rowton added. With the rapid evolution of new sustainable investment approaches, regulation has also been playing catch up, she noted. (See chart below on types of ESG indexes.)

Impact of geopolitics

“The Russian/Ukraine conflict has created near-term headwinds in the form of rising crude prices and inflation. This should ultimately support demand for the products and services of an ESG investor and sustainable strategies, given the necessity of developing renewable alternatives to fossil fuels and energy efficiency. To our minds, there are particular attractions in allocating to climate-focused solution providers,” said Julianne McHugh, head of sustainable equities at Newton Investment Management.

While the war in Ukraine has had adverse consequences globally on food and energy supplies, it has also widened the sustainability focus to additional sectors of the global economy, said Therese Niklasson, head of sustainable investment at Newton Investment Management. The conflict has stirred an important debate around the positive social utility of security and defense, sectors that have, for many years, been excluded from funds focusing on ESG criteria.

“There is also the current discussion of how to deal with Russian investments responsibly,” Niklasson said, adding that investors need to think about the social impact of divestment and other issues too. “Finally, the focus on nuclear [power] and European energy policy has changed.”

As these wider issues are being discussed, the definition of ESG and sustainability are continuing to evolve, said McHugh. At Newton, “ESG is not just about controlling [financial] risk, but also [about] understanding the investment opportunities that come with the need to address sustainability, both in the shape of dedicated solutions and general fundamental analysis.”

Nuances in interpretation

Asset owners need to understand the various definitions of sustainable investing, which can have different nuances. “We have to acknowledge that there’s a broad movement in ESG investing and that there are distinct subapproaches within it,” said Stephen Freedman, head of research and sustainability, thematic equities, at Pictet Asset Management. The firm uses “responsible investing” to describe the broad category, rather than “sustainable investing.”

Regardless of the terminology deployed, Freedman noted that because of COP26 — the 2021 United Nations Climate Change Conference — and similar initiatives, as well as real-world events, the adoption of sustainable-investment approaches are accelerating.

“The geopolitically induced surge in fossil fuel prices has made alternative energy sources even more cost competitive,” Freedman said. With the desire to reduce dependence on imported Russian oil and gas, renewable energy, which tends to be domestically sourced, is further strengthened. “These dynamics should be supportive of COP26’s net-zero goals.”

Biodiversity is the next major sustainable-investment concern, Freedman said. “It is a broad agenda on the political and the policymaking side and, increasingly, in the investment community.” The climate agenda has provided useful templates on how to proceed, he said. For instance, the U.N. Task Force on Climate-Related Financial Disclosures, or TCFD, provides guidelines for corporate financial disclosures relating to climate impacts. “The templates mean that we’re able to get started much more quickly. Since biodiversity is linked to multiple environmental challenges, focusing on it opens the doors to a much broader perspective on environmental investing.”

The efficient frontier

Clarity AI, a sustainability technology firm that uses machine learning and big data, is seeing an acceleration in the adoption of sustainable-investing frameworks by investors, said Rodolphe Bocquet, vice president of partnerships and regulation at the firm. Investor concerns range from “environmental collapse and climate change to biodiversity and, to some extent, the impact of COVID-19,” he said, adding that “Social inequality can impact returns at the macroeconomic level.”

Sustainable investing is, in many ways, an evolution of traditional investment modeling with the addition of societal and environmental dimensions that are not captured by conventional measures of risk and return, Bocquet noted. “Investors have focused on the efficient frontier, the sweet spot between risk and return. Through the mainstreaming of sustainable investing, there is a third dimension which is added to the framework: the impact of, or social return on, an investment. Investors are now trying to optimize and find the sweet spot in this new efficient frontier of the three dimensions: risk, financial return and social return.”

As institutional investors weigh these dimensions, they may lean more toward one objective versus another, such as risk reduction or social impact, for instance, said Ángel Agudo, vice president of product at Clarity AI. Using ESG criteria gives investors additional information: “Investors try to incorporate as many signals as possible to identify opportunities, including along ESG dimensions,” he said.

THE ESG LENS WIDENS

While asset owners have been keen to address climate change and social impact in their investment portfolios, with many adopting the view that environmental, social and governance factors impact financial returns, the lack of available data has hindered the inclusion of ESG in practice, until recently. The metrics have been widely available for public equities, and now, buoyed by strong investor interest, they are widening to cover the other asset classes and adding more ESG investment themes.

Public equities still form the bulk of ESG assets, said Ángel Agudo, vice president of product at Clarity AI. “Most of Clarity AI’s coverage is on public equities and fixed income. We are extending this coverage to private companies,” he said.

“Investors want to have an integrated and consistent approach when it comes to sustainability performance reporting of their portfolio. They want ESG data not just in public equities, but across the board,” added Rodolphe Bocquet, vice president of partnerships and regulation at Clarity AI. He said he sees growing demand for data on areas related to social impact, biodiversity and human rights.

Clarity AI’s addition of private-company sustainability information to its public company information allows for comparison across ESG metrics. “We [offer] benchmarking for private companies and are able to report to limited partners on their ESG” scores, Agudo said. “Through our experience, information and classifications, we facilitate engagement by our clients, and we also offer companies options to disclose their data,” he said.

Beyond equities

Stephanie Rowton, director of ESG indices at S&P Dow Jones Indices, said that she anticipates growth in sustainable fixed-income investing, which has previously faced hurdles in ESG integration due to a lack of available data. “Applying ESG to fixed-income analysis, while more challenging than equities, isn’t impossible,” she said. Following the merger of S&P Global and IHS Markit in Feb. 2022, the firm is launching more fixed-income ESG indexes, including its first Paris-aligned climate transition index in fixed income.

Driven by increasing client demand, S&P Dow Jones Indices has expanded into additional asset classes such as infrastructure and commodities, Rowton said. The firm has also launched indexes related to the carbon-emissions market, electric vehicles and commodity futures. “We’ve been working hard to offer indices which look to ‘greenify’ commodities,” Rowton said.

Read: S&P Dow Jones Indices ESG Solutions

On the social-impact side, there is strong demand for ESG-focused products, particularly as more data becomes available, Rowton said. “There’s a rise in interest in the ‘S’, particularly after the #MeToo movement and the Black Lives Matter movement. And we are starting to see an interest in the social risks of climate change as we transition to net-zero.”

“Clients are at different stages of their ESG journey, so it’s important that we provide solutions including sustainability screen indices that meet all aspects of their needs,” Rowton said. Regular engagement is not part of her group’s approach, though other S&P Global divisions regularly engage with companies. “In general, as an independent index provider, we do not engage with constituents directly.”

Expanding themes

The number of asset classes incorporated into sustainable solutions, the investment themes and client demand are all growing across the board, said Therese Niklasson, head of sustainable investment at Newton Investment Management. “It has expanded across the fixed-income space to include sovereigns and corporate fixed income over the last few years,” she said. Derivatives remain an outlier because the industry has not yet been able to build an ESG framework for analysis, she noted, adding that “while you would have an exposure to the underlying issues, such as climate risk, we don’t believe that derivatives necessarily have a negative impact on ESG outcomes.”

In terms of themes of interest to Newton’s clients, “the net-zero focus in Europe has been dominant,” Niklasson said. Food as an investment theme has also gained momentum, said Julianne McHugh, head of sustainable equities at the firm, which offers strategies related to the future of food. “Food security is not a new issue but the Russia/Ukraine conflict has pressured the agriculture complex [as has] global population growth and climate change.” (See chart on global food exports from Ukraine and Russia.)

Newton’s approach to sustainable investments follows three main tracks: solution providers, balanced stakeholders and transition stocks, Niklasson said. In the context of net-zero, the transition philosophy offers an interesting approach by seeking out companies across sectors that are not yet best in class but have strong early momentum around addressing their more critical negative external factors, she added.

Positive Change

While ESG investing has traditionally been used as a risk-mitigation framework, it has broadened to include the goals of positive change in the environment or society. “In our thematic approach to ESG, we’re focused on goods and services that companies are offering that provide a solution to an environmental problem,” said Stephen Freedman, head of research and sustainability, thematic equities, at Pictet Asset Management.

For example, among its numerous environmental strategies, Pictet Asset Managment offers a timber strategy that invests in sustainable forestry in which trees are replanted at the rate they are harvested and that encourages the use of natural carbon sinks, he said. “On the ‘S’ side, nutrition strategies, including alternatives to meat, are an area of focus. For ‘G,’ we run a strategy called ‘Pictet-Family,’ which invests in family businesses with a [focus] on their durability and governance processes.” Biodiversity is a rapidly emerging theme as well, Freedman said.

In driving positive change through investments, “shareholder engagement is critical,” Freedman added. “Beyond that, thematic equities can drive capital directly to impactful companies by participating initial public offerings, hence influencing smaller companies through their access to and cost of capital.”

DATA ADVANCES ON ALL FRONTS

As sustainable investing continues its drive forward, data challenges are being addressed by both global and country efforts to improve data standardization and reporting. Increased harmonization among global standard-setting bodies is driving a more consistent approach to data and disclosures. As these efforts progress, asset managers continue to build on their proprietary data to plug gaps in public coverage and deliver an active investment edge.

“There is a tension between standardization and the need to cater data to a specific thematic approach,” said Stephen Freedman, head of research and sustainability, thematic equities, at Pictet Asset Management. The firm pursues a dual approach, using a combination of commercial environmental, social and governance data and its own proprietary metrics.

“For environmental footprinting, we developed a proprietary model that relies on the Planetary Boundaries framework [that was] developed by academics at the Stockholm Resilience Centre. This approach identifies nine environmental dimensions — [among them are] climate change, chemical pollution and land-use change — that describe key features of the ecosphere,” Freedman said. While this framework was created for policymaking, Pictet Asset Management uses it as an investment tool. “We continue to develop new insights as the science itself keeps evolving,” he said.

Improving consistency

Global initiatives such as the Task Force on Climate-Related Financial Disclosures, or TCFD, and the more recent Taskforce on Nature-Related Financial Disclosures, TNFD, are proving critical to improving data through standardization of disclosures, Freeman said. “These [provide] a common framework for companies to disclose information. That doesn’t prevent an investor from interpreting that information as they choose, but it’s important that we go in that standardized direction. Otherwise, disclosure becomes cost-prohibitive for companies and confusing for investors.”

Regulation is driving increased consistency in ESG data, said Rodolphe Bocquet, vice president of partnerships and regulation at Clarity AI. “Regulators across the globe are implementing regulation of ESG data providers. Data providers will need to be more transparent in their methodology and to demonstrate how they prevent conflicts of interest when they are also advising companies on how to improve their ratings.”

“ESG data can be inconsistent. There is a definite need for standardization,” said Stephanie Rowton, director, ESG Indices, S&P Dow Jones Indices. There are signs of progress emanating from standard-setting bodies, such as the Sustainability Accounting Standards Board, or SASB, she said. “We should see increased convergence in ESG data metrics. Globally consistent and transparent sustainability reporting will strengthen capital markets and improve our indices.”

Multilayered approach

Ángel Agudo, vice president of product at Clarity AI, said he sees progress on several fronts under the leadership of the European Corporate Sustainability Reporting Directive, or CSRD, and the International Sustainability Standards Board, ISSB. “Metrics driven by the regulation are becoming standardized and comparable across companies. We are going to see progress in disclosures and a more reliable decision-making process for investors.”

Clarity AI offers proprietary approaches to data that incorporate multiple measures drawn from multiple data feeds. Agudo detailed the company’s approach: “We collect data in real time so that the information is more frequent than from company disclosures. We use technology to analyze information coming from the news about a company and its implication for ESG. We incorporate information from additional providers with specialized metrics, such as the CDP (the not-for-profit charity that runs the global climate disclosure system). Lastly, we use estimation models.”

Read: Quantifying Corporate Societal Impact Using United Nations’ Sustainable Development Goals

When ESG information is not directly available by other measures, Clarity AI’s estimation models derive an ESG profile of a company based on its unique AI-driven approach, Agudo said. (See chart below on its ESG estimation model process.)

S&P Dow Jones Indices also uses a proprietary data approach to address challenges relating to data gaps, particularly in such areas of concern as biodiversity data, Rowton said. When incorporating the latest regulatory and industry data trends, “we take time to consider the regulation and how it could affect us and our clients. We’re in a privileged position as a global index leader, and we don’t take this responsibility lightly.”

A holistic view

“We have advocated for, and spoken about, the importance of harmonization in reporting and data,” said Therese Niklasson, head of sustainable investment at Newton Investment Management. In addition to advocating for a public policy solutions, the asset management firm uses its own approaches to improve data.

Newton has a proprietary model that identifies potential environmental, social and governance risks, said Julianne McHugh, head of sustainable equities. Data alone often doesn’t reveal the whole story, context is needed as well, she said, offering diversity as an example. Board diversity is a standard ESG metric, but Newton also engages with management to focus on diversity opportunities across the company. Our focus “is making sure that the broader workforce can get the experience, equality and opportunity for career development which, in our view, results in a more diverse and more engaged workforce at all levels,” McHugh said.

GREEN LIGHTS AHEAD

What does the future hold for sustainable investing? According to the consensus view among industry experts, more coverage by asset class; more themes, such as biodiversity and food security; and greater adoption by investor type and across regions. However, differences in preferences and implementation of sustainability are expected to persist across regions.

“U.S. investors will continue to increase their adoption of sustainable investing, but it’s going to take a different path [than in] Europe because of cultural differences and priorities,” said Julianne McHugh, head of sustainable equities at Newton Investment Management. “U.S. institutional investors might be less willing to sacrifice investment returns for outcomes. And hence the products that will be more popular will be those that provide positive outcomes and positive returns.”

Read: Thematic equities as impact investments

Looking at the global picture, McHugh’s colleague at Newton, Therese Niklasson, who’s head of sustainable investment, said that while she sees growth in emerging market sustainable investments, she also sees a need for more commitment. “We should challenge ourselves to ensure that what we are doing is dealing with a real-world problem. Seventy to eighty percent of all sustainable [assets under management] is in developed markets. The funding gap is in emerging markets; so there is a mismatch here and, in the growing pursuit of purified portfolios, from an ESG perspective, this needs more attention.”

The movement toward the net-zero economy will continue to be a significant focus for both global investors and governments, Niklasson added. Contributing to decarbonization will not be a linear exercise, and investors must strike the right balance between investing in solutions and financing the transition in a just and inclusive way. Newton’s focus will continue to be on transition plans for financed emissions coupled with a deep engagement commitment, she said.

An impact approach

“Individual investors interested in sustainability typically want to induce change rather than simply invest in a portfolio of sustainable companies,” said Stephen Freedman, head of research and sustainability, thematic equities, at Pictet Asset Management. The firm’s thematic equities offering is impact-oriented and therefore meets this investor need, he said. “It targets companies whose goods and services offer tangible links to environmental or social outcomes. That is why it has been part of the fastest-growing segment of responsible investing, attracting institutional investors too.”

Environmental, social and governance investing is evolving along multiple dimensions, Freedman said, and investors need to choose asset managers who are at the forefront. “It’s a space that requires combining interdisciplinary insights from environmental science and social sciences into an investment framework to succeed. It’s important to consider this dedication when looking for an asset manager, as opposed to simply buying an off-the-shelf solution.”

When it comes to selecting a sustainable-investment manager, Freedman offered pragmatic advice. “Understand how involved the asset managers are in developing their own solutions and their partnerships with academia to advance the frontier. These will distinguish the ESG leaders of tomorrow from those that are just following the pack.”

Corporate commitment

The likely future of sustainable investing is where continued improvement of data, driven by regulation, should facilitate greater adoption of sustainable-investment practices. “Regulation is going to be the key leverage. The availability and quality of data are going to change the adoption of ESG. It is no longer just a specialized theme of asset owners pursuing ESG; it has now spread across all investment analysis,” said Ángel Agudo, vice president of product at Clarity AI. Investors are paying closer attention to the implications of ESG analysis, whether for companies’ energy transition plans or their governance processes, he said.

Rodolphe Bocquet, vice president of partnerships and regulation at Clarity AI, shared his forecast that “in five years, it’s not going to be possible to be a chief investment officer without having a very strong background in sustainable investment.” How impact is being managed from within an organization, who is responsible for it and how it is being monitored will be key areas of corporate governance, he said. “Linking compensation to sustainability performance is also becoming the norm. Investors at large [firms] will be increasingly required to demonstrate positive real-world impact, and they will be competitively assessed on this metric by their clients.”

Aligning retiree assets

The future of sustainable investing, according to Stephanie Rowton, director of ESG indices at S&P Dow Jones Indices, is one of expanding into new markets, such as defined contribution plans, and improving ESG metrics overall.

“DC plans and sustainable investing are aligned. Individuals and asset owners in DC plans are looking to achieve long-term returns, and sustainable investing is about placing your money in companies that are building responsible, long-term businesses,” she said. The wealth transfer from baby boomers to millennials and younger generations, who tend to be more socially aware, will encourage sustainable investments in DC plan menus, Rowton noted. “The wealth transfer presents a huge opportunity for sustainable investing on DC platforms.”

On the ESG data side, there will be “greater monitoring and clear goal-setting with regards to diversity and inclusion as well as biodiversity,” Rowton said. S&P Dow Jones Indices has introduced two thematic sustainable-farming indexes. Rowton said she expects progress on biodiversity data with the introduction of the biodiversity-measurement framework at the next United Nations Convention on Biological Diversity, or COP15 Conference, in October.

Her conclusion: “I expect to see more companies setting clear goals, more monitoring of these targets and a greater focus on the topic of biodiversity.”