Diversification was hard to come by for global investors last year. Rising U.S. interest rates sank almost all boats in a coordinated sell-off across capital markets: U.S. equities were down 18.1%, U.S. investment-grade bonds were down 15.6%, nominal Treasuries were down 12.5% and inflation-linked Treasuries were down 11.8%. European assets followed a similar path, with deviations linked primarily to the differential between local rates and U.S. rates (and the resultant impact on currencies).

The story in Asian markets was quite different.

In China, domestic policy decisions on COVID-19 restrictions, real estate developer leverage and technology company regulations had a significant impact on market returns. Chinese equities finished the year down 21.8%, slightly worse than the U.S. but following a very different path. Chinese equity markets were up 3.2% in the second quarter of 2022 when the U.S. was experiencing its largest quarterly loss for the year (-16.1%).

Chinese monetary policy took a stimulative stance taking rates down from 3.8% to 3.65% to address the various headwinds facing the economy, which resulted in China being the rare market to experience positive returns for government bonds.

In India, the economy needed no monetary stimulation, with domestic development tailwinds outweighing global headwinds to make India one of the fastest growing large economies. Despite India seeing record net outflows of $16 billion from foreign investors through the year (equivalent to -0.5% of the aggregate market cap), domestic sentiment on equities remained strong and the equity market was up 3.0% in Indian rupee terms (though down 8.0% in U.S. dollar).

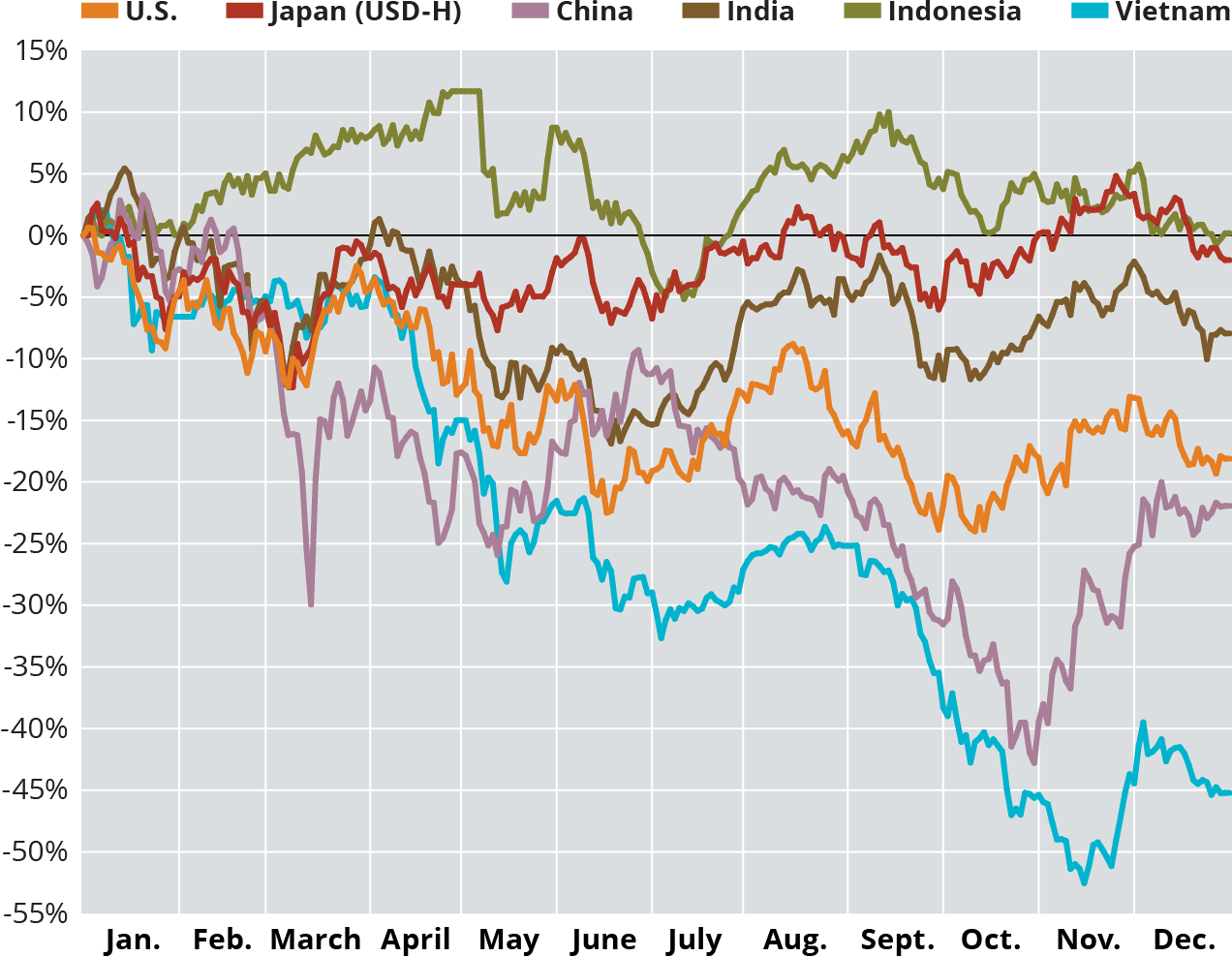

Japan held firm to their yield curve control approach through most of the year, maintaining relatively flat equity market performance while seeing the yen drift as low as ¥150/$ vs. ¥115/$ at the start of 2022. In the smaller markets of Southeast Asia, there were also significant deviations in performance, with Indonesia and Thailand generating positive returns (in local currency and U.S. dollar terms), while Vietnamese equities lost more than 40% of their value. The spread of performance of these various markets is shown below.